All Categories

Featured

The youngster cyclist is purchased with the notion that your youngster's funeral expenditures will certainly be completely covered. Youngster insurance riders have a fatality advantage that varies from $5,000 to $25,000.

Your kid has to likewise be between the ages of 15 days to 18 years old. They can be covered under this plan up until they are 25 years of ages. Also, note that this policy only covers your children not your grandchildren. Last expense insurance plan advantages do not finish when you sign up with a policy.

Motorcyclists can be found in various kinds and offer their very own advantages and incentives for signing up with. Cyclists are worth checking into if these supplemental alternatives apply to you. Cyclists include: Accelerated death benefitChild riderLong-term careTerm conversionWaiver of premium The accelerated survivor benefit is for those who are terminally ill. If you are seriously unwell and, depending upon your specific plan, determined to live no more than six months to two years.

The Accelerated Death Benefit (most of the times) is not exhausted as income. The drawback is that it's mosting likely to minimize the death benefit for your beneficiaries. Obtaining this likewise requires proof that you will not live past 6 months to 2 years. The child rider is acquired with the idea that your kid's funeral service expenses will certainly be completely covered.

Coverage can last up till the youngster turns 25. Note that you may not be able to sign your child up if he or she suffers from a pre-existing and deadly problem. The lasting care cyclist is comparable in idea to the sped up death advantage. With this one, the idea behind it isn't based on having a brief quantity of time to live.

This is a living benefit. It can be obtained against, which is very useful because lasting treatment is a significant cost to cover.

Selling Final Expense Insurance

The reward behind this is that you can make the button without undergoing a medical examination. funeral expense cover. And because you will no more be on the term plan, this also suggests that you no more have to stress over outliving your plan and losing on your fatality benefit

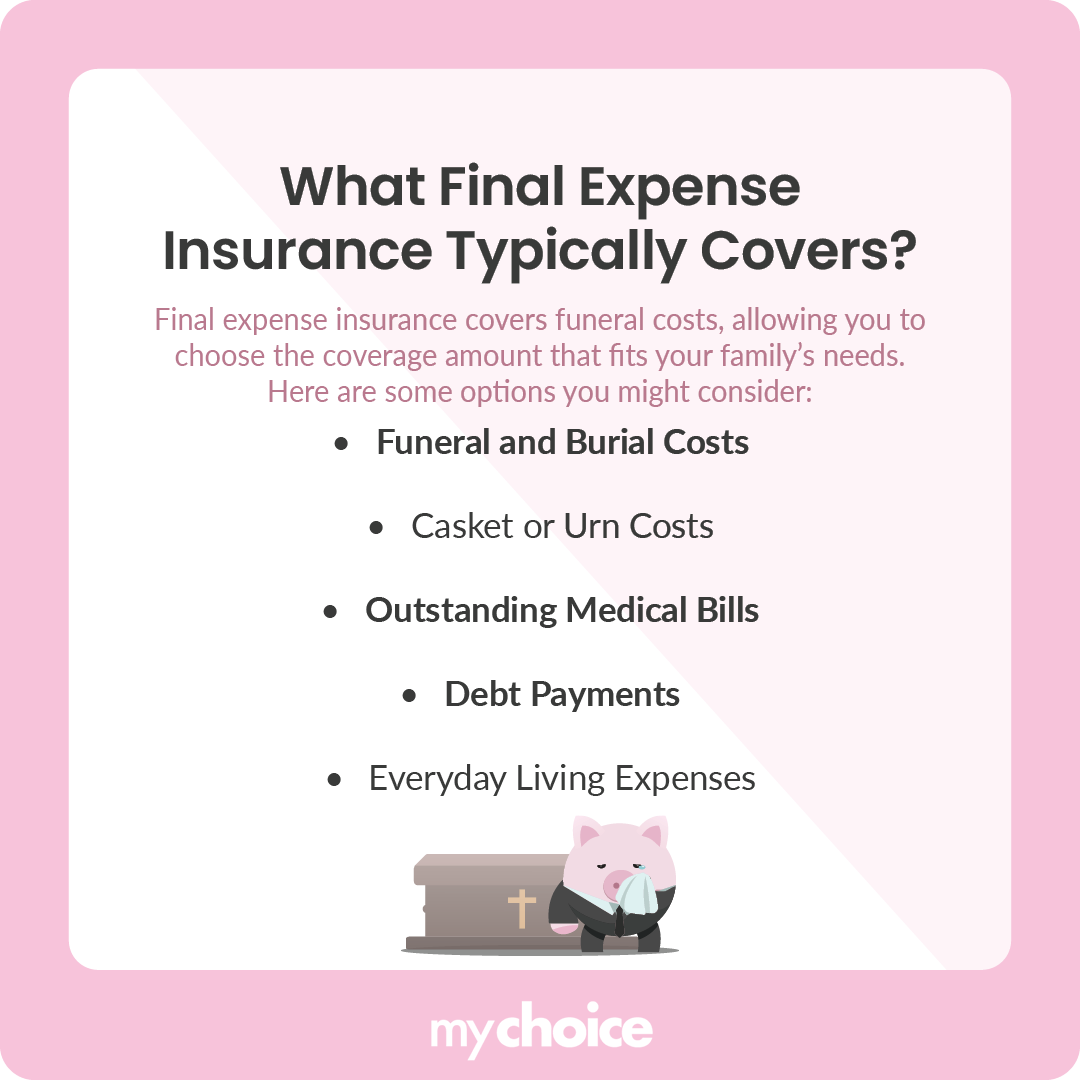

The exact amount relies on various variables, such as: Older individuals usually encounter higher costs because of boosted wellness dangers. Those with existing health conditions may come across higher costs or restrictions on insurance coverage. Greater protection amounts will naturally result in higher costs. Bear in mind, policies usually top out around $40,000.

Take into consideration the regular monthly premium repayments, however likewise the satisfaction and monetary security it gives your household. For numerous, the reassurance that their liked ones will not be strained with monetary difficulty during a hard time makes last cost insurance a rewarding investment. There are two sorts of last expenditure insurance policy:: This type is best for people in fairly healthiness that are looking for a means to cover end-of-life expenses.

Insurance coverage amounts for streamlined problem policies usually increase to $40,000.: This kind is best for people whose age or health and wellness prevents them from buying other sorts of life insurance policy coverage. There are no health needs in any way with ensured problem policies, so any person that fulfills the age requirements can typically qualify.

What Is Final Expense Insurance

Below are some of the variables you should consider: Evaluate the application procedure for different policies. Some may need you to answer health and wellness concerns, while others supply assured concern alternatives. Make certain the carrier that you select uses the amount of insurance coverage that you're looking for. Consider the settlement alternatives offered from each carrier such as monthly, quarterly, or annual costs.

Latest Posts

National Burial Insurance Company

Insurance Burial Plan

Final Expense Insurance Policies